AI-Powered Video KYC for Banking

Rebuilding Digital Onboarding & Revenue During COVID

Domain: Fintech · AI/ML · Digital Identity · Banking

Platforms: Customer Mobile App · Relationship Officer Web Dashboard

Role: Senior Product Designer

Executive Summary

Designed and led an AI-powered Video KYC platform that replaced branch-dependent identity verification during COVID. The solution enabled customers to complete secure onboarding remotely while helping relationship officers verify cases faster using AI-assisted confidence signals and exception handling. The platform reduced verification time by 20%, improved conversion by 15%, and became the foundation for scalable digital onboarding in a regulated banking environment.

Overview

When COVID-19 forced bank branches to close, customer acquisition dropped sharply. Credit card onboarding relied heavily on in-person KYC, creating stalled pipelines, rising operational costs, and lost revenue.

This project focused on designing an AI-powered Video KYC (VKYC) platform that allowed customers to complete identity verification remotely while enabling relationship officers to continue onboarding at scale.

The challenge wasn’t just replacing physical verification, it was designing a system that balanced AI automation, human judgment, and regulatory trust in a high-risk financial environment.

My Role

As the Senior Product Designer, I owned the end-to-end experience across customer and internal operator workflows. I :

-

Led product discovery and UX strategy for a large-scale AI-driven banking platform

-

Partnered closely with Product, Engineering, Compliance, Legal, and Business teams

-

Translated regulatory and AI constraints into usable, trustworthy experiences

-

Designed customer mobile flows and relationship officer dashboards

-

Defined AI-assisted decision models, confidence indicators, and exception handling

-

Owned design QA, system alignment, and production handoff across web and mobile

Business Impact

Measured outcomes post-launch:

-

15% increase in monthly credit card conversion

-

20% reduction in total verification completion time

-

30% reduction in relationship officer case handling time

-

25% decrease in customer complaints related to verification delays

-

15% reduction in onboarding drop-off

The platform directly contributed to revenue recovery during the pandemic while establishing a scalable digital identity foundation.

Business Challenge

-

Branch-dependent KYC became impossible during lockdowns

-

Manual verification created operational backlogs and burnout

-

Customers were anxious about safety, delays, and data security

-

Compliance requirements remained non-negotiable

-

The solution had to scale quickly without increasing fraud risk

This was a high-risk, high-impact system operating under regulatory scrutiny and extreme time pressure.

Research & Discovery

Primary Research:

-

Interviews with relationship officers handling daily KYC operations

-

Interviews with customers applying for credit cards during COVID

Secondary Research:

-

Review of global digital KYC and AML standards

-

Analysis of existing VKYC solutions and regulatory interpretations

Key Insights

Relationship Officers:

-

Lost ability to meet customers directly, impacting sales targets

-

Manual verification increased stress and rework

-

Needed AI support, not black-box decisions

Customers:

-

Avoided branches due to health concerns

-

Frustrated by long, opaque onboarding processes

-

Needed reassurance around privacy, legitimacy, and progress

Core Insight:

A successful VKYC system had to augment human decision-making, not replace it and make AI behavior visible, explainable, and trustworthy.

Competitive Analysis

I benchmarked platforms like Ondato, Jumio, and Veri5 Digital, focusing on:

-

Depth of AI verification (OCR, face match, liveness)

-

UX clarity in compliance-heavy flows

-

Trust signals and transparency

-

Internal dashboards for operational teams

Opportunity Identified:

Most competitors optimized for compliance accuracy but under-designed for operator efficiency and customer confidence.

UX Problem Statement

"How might we enable customers to complete KYC remotely while empowering relationship officers to onboard faster, at scale, without compromising regulatory trust?"

Solution Strategy

-

AI-first verification to reduce manual effort

-

Clear role separation between customer and officer experiences

-

Real-time feedback during document and face verification

-

Operator dashboards optimized for exception handling

-

Progressive disclosure to reduce cognitive overload

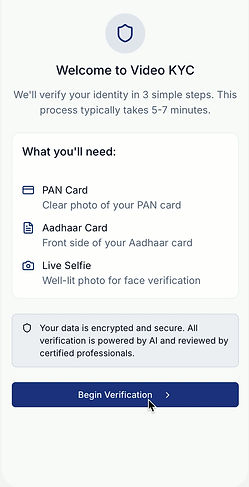

Product Architecture (High Level)

Customer (Mobile):

-

PAN verification via OCR and backend validation

-

Aadhaar verification using QR / XML

-

Live face capture with liveness detection

-

Seamless transition into a video call

Relationship Officer (Web):

-

Central dashboard of assigned cases

-

AI confidence scores for each verification step

-

Video session management

-

Exception handling for flagged or failed cases

This architecture allowed AI to handle routine checks while reserving human attention for edge cases.

Key AI-Powered Features

Document Verification

-

OCR-based PAN extraction with backend validation

-

Aadhaar QR and XML verification

-

Automated mismatch detection and alerts

Face Verification

-

Live face capture

-

Face match against document photo

-

Liveness detection to prevent spoofing

Risk & Context Signals

-

Location verification

-

Discrepancy alerts surfaced to officers

-

Confidence scores instead of binary pass/fail outcomes

Relationship Officer Dashboard

The dashboard acted as the operational control center for verification teams.

It provided:

-

Clear visibility into assigned, pending, and flagged cases

-

Step-level verification status and AI confidence indicators

-

Access to documents, videos, and recorded sessions

-

Fast paths for approval, escalation, or rejection

By surfacing only what required human judgment, the dashboard significantly reduced cognitive load and handling time.

Customer Mobile Experience

The customer experience was designed to feel fast, safe, and human, despite being AI-driven.

Key principles:

-

Guided, step-by-step flows

-

Clear progress indicators

-

Minimal manual input through AI assistance

-

Explicit reassurance around data privacy and security

The goal was to replace the anxiety of in-branch verification with clarity and confidence at home.

Design Decisions & Trade-offs

-

Used confidence scores instead of binary outcomes to support human judgment

-

Chose progressive disclosure over dense compliance screens

-

Prioritized operator efficiency over visual complexity

-

Accepted slightly longer customer flows to maintain regulatory trust

These decisions aligned business risk tolerance with usability and scale.

Design QA & Handoff

-

Delivered responsive designs across web and mobile

-

Aligned components with a shared design system

-

Conducted multiple design QA cycles with engineering

-

Ensured AI edge cases, failures, and fallback states were handled gracefully

Outcome

The AI-powered Video KYC platform successfully replaced branch-dependent onboarding with a scalable, compliant, and human-centered digital experience.

It enabled the business to recover lost revenue during the pandemic while establishing a long-term foundation for digital identity and AI-assisted onboarding across banking products.